Whether you are selling handcrafted goods, managing event registration, or offering services, Cognito Forms empowers you to start collecting and managing payments with our seamless PayPal integration. There’s absolutely no additional charge to process these payments with Cognito Forms.

Sign UpAvailable to organizations on our Team and Enterprise plans.

Drive Conversion with PayPal

PayPal’s brand recognition helps give customers the confidence to buy. It’s easy to add to your checkout solution with Cognito Forms.

Boost Sales with Pay Later in PayPal Checkout.

Let customers pay in installments with Pay in 4 and Pay Monthly¹ – while you get paid upfront at no extra cost to you.

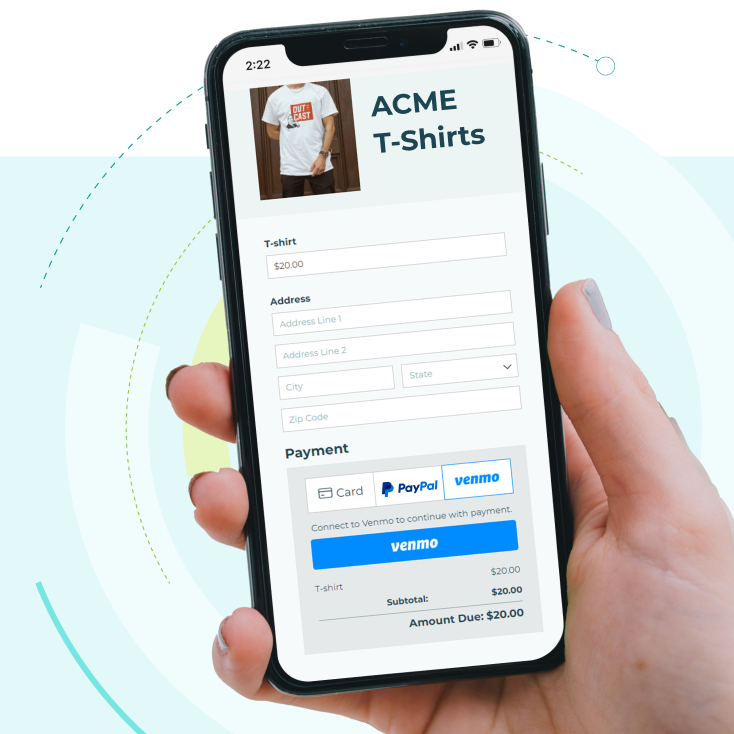

Accept Credit Cards and Venmo

Take charge.

Collect payment from all major debit and credit cards directly in your form - no redirect. It’s easy to manage, and PayPal handles the processing.

**Credit Card Processing available in US, CA, UK, AU, FR, IT, ES

Tap into NextGen spending power with Venmo.

Gain appeal to Venmo customers (US only) who are active spenders³ with more spending power.⁴

Venmo users spend 2x more.⁵

Free PayPal Payment Form Templates

From product sales to service invoices, discover the ease of online transactions with our collection of ready-to-use payment templates designed for seamless PayPal integration.

Choose a template, customize it to fit your brand, and you’re all set to process payments with the reliability and security of PayPal on Cognito Forms.

View the TemplatesSafeguard Your Data and Finances

Embrace the peace of mind with the data protection that comes with PayPal - including PCI compliance, a platform prepared for PSD2 (in the EU and EEA), and AI-powered fraud detection.

Combined with Cognito Forms’ adherence to CCPA, GDPR, and PSD2 readiness, this partnership ensures that your payment processing is not only secure but also at the forefront of data protection standards.

PayPal is Preferred, Trusted, and Familiar to Customers6

20+

years of experience

200+

markets around the Globe

100+

different currencies

Pricing with No Surprises

Only pay when you get paid.⁷ PayPal doesn’t charge monthly or setup fees for collecting payments with Cognito Forms. The PayPal fee for transactions is 3.49% + $0.49.* Cognito Forms never charges any transaction fees for PayPal payments.

Cognito Forms organizations get a special lower rate for PayPal card processing.

2.49% + $0.39*

*US domestic fees; fees vary by country and are subject to change.

Frequently Asked Questions

You will need to select PayPal from the list of payment accounts when building a form. Learn More

The PayPal integration with Cognito Forms requires a PayPal Business or PayPal Pro PayPal account. This allows you access to various PayPal products, including PayPal Checkout, and gives you the ability to accept credit card and debit card payments.

Payments through your Cognito Forms are PCI Compliant. Learn More

You can issue a refund on the entries page in Cognito Forms. To refund through Cognito Forms, select the entry from your Entries menu and click Refund in the green box under Payment Summary. To issue a partial refund, you will need to go through PayPal.

Your existing PayPal buttons display a Venmo button. When payers select Venmo, they can pay in the Venmo app. You must have the Venmo app installed and have an account.

No! There is no limit to how many payments you can accept.

You are limited to 10,000 entries on the Teams Plan. You get unlimited entries on the Enterprise Plan.

¹About Pay in 4: Loans to CA residents are made or arranged pursuant to a CA Financing Law License. PayPal, Inc. is a GA Installment Lender Licensee, NMLS #910457. RI Small Loan Lender Licensee.

Pay Monthly is subject to consumer credit approval. Term lengths and fixed APR of 9.99-35.99% vary based on the customer’s creditworthiness. The lender for Pay Monthly is WebBank. PayPal, Inc. (NMLS #910457): RI Loan Broker Licensee. VT Loan Solicitation Licensee.

²Nielsen Behavioral Panel of USA with 29K SMB monthly average desktop purchase transactions, from 13K consumers between April 2022-March 2023. Nielsen Attitudinal Survey of USA (June 2023) with 2,001 recent purchasers (past 4 weeks) from SMB merchants, including 1,000 PayPal transactions & 1,001 non-PayPal transactions.

³Focus Vision, Commissioned by PayPal. October 2020. The Venmo Behavior Study explores valuable insights for merchants to consider to reach a broader audience including 2,217 Venmo customers' financial habits, purchasing behaviors and perceptions of Venmo as a payments tool.

⁴50% of Venmo users are more likely to have a high household income than online payment users overall. (Page 8). Source: Statista Global Consumer Survey as on July 2020. The target population are internet users in U.S. between 18 and 64 years of age.

⁵Edison Trends, commissioned by PayPal, April 2020 to March 2021. Edison Trends conducted a behavioral panel of email receipts from 306,939 US consumers and 3.4+ M purchases at a vertical level between Pay with Venmo and Non-Venmo users during a 12-month period.

⁶Morning Consult - The 15 Most Trusted Brands Globally. Mark 201. Morning Consult surveyed over 330,000 consumers across 10 international markets to provide a global view on the current state of consumer trust across brands.

⁷Our standard rate pricing listed herein is for US transactions only in USD and is effective starting on August 2, 2021.